Can I Use a Credit Card for Cash App? A Comprehensive Guide

Cash App has revolutionized how we handle quick transactions, from splitting bills with friends to paying for services on the go. But what happens when your bank account is running low, and you need to send money urgently? The question inevitably arises: Can I use a credit card for Cash App? This comprehensive guide dives deep into the intricacies of using credit cards on Cash App, exploring the associated fees, potential benefits, and crucial considerations to help you make informed financial decisions. We aim to provide clarity and expert insights, ensuring you understand the full picture before linking your credit card to Cash App.

Understanding Cash App and Its Funding Sources

Cash App, developed by Block, Inc. (formerly Square, Inc.), is a mobile payment service that allows users to transfer money to one another using a mobile phone app. It’s widely used for various purposes, including peer-to-peer payments, investing in stocks, and even Bitcoin transactions. To facilitate these transactions, Cash App requires a funding source, which can be a linked bank account, a debit card, or a credit card. Understanding how these funding sources interact with Cash App is crucial for managing your finances effectively.

When you link a bank account or debit card, Cash App typically processes transactions directly from your available balance. This usually involves minimal or no fees. However, when you opt to use a credit card, the dynamics change, primarily due to the way credit card companies classify Cash App transactions.

The Core Issue: Cash Advances and Credit Card Transactions

The fundamental reason why using a credit card on Cash App requires careful consideration is the potential for transactions to be classified as cash advances. Credit card companies often categorize transactions involving money transfers or digital wallets like Cash App as cash advances rather than standard purchases. This distinction carries significant implications regarding fees and interest rates.

Cash advances typically come with higher interest rates than standard purchases, often significantly so. Furthermore, interest on cash advances may accrue immediately, without the grace period that typically applies to purchases. This means that even if you pay off your balance in full each month, you could still incur interest charges on cash advances made through Cash App. In addition to higher interest rates, cash advances often involve transaction fees, which can further increase the cost of using a credit card on Cash App.

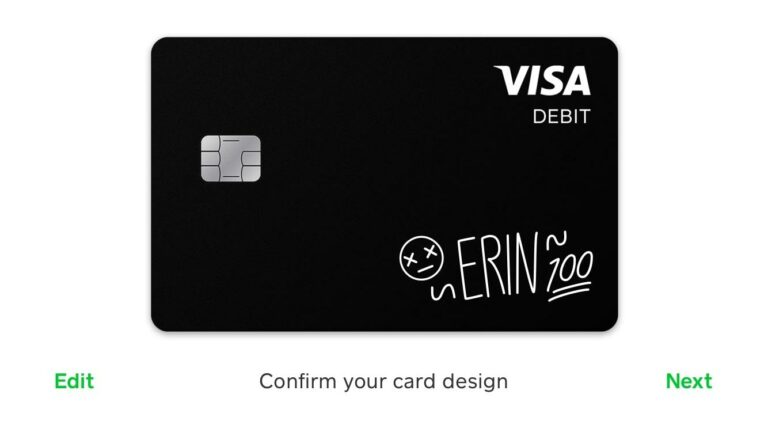

How to Add a Credit Card to Cash App

Adding a credit card to your Cash App account is a straightforward process. Here’s a step-by-step guide:

- Open Cash App: Launch the Cash App application on your smartphone.

- Tap the Profile Icon: Locate and tap the profile icon, usually found in the upper-right corner of the screen.

- Select “Linked Banks”: Scroll down and select the option labeled “Linked Banks.”

- Add Bank or Card: Choose the option to “Add Bank” or “Add Card.”

- Enter Credit Card Details: Enter your credit card number, expiration date, CVV code, and billing address. Ensure all information is accurate to avoid any issues during verification.

- Verify Your Card: Cash App may require you to verify your card. This can involve a small temporary charge to your card or a request to confirm information with your credit card issuer.

Once your credit card is successfully added and verified, you can use it to send payments through Cash App. However, it’s crucial to be aware of the potential fees and interest charges associated with using a credit card, as discussed earlier.

Cash App Fees: Credit Cards vs. Other Payment Methods

Cash App generally doesn’t charge fees for standard transactions when using a linked bank account or debit card. However, a fee is typically applied when using a credit card to send money. As of late 2024, this fee is generally around 3% of the transaction amount. For example, if you send $100 using your credit card, Cash App may charge a $3 fee, resulting in a total charge of $103 to your credit card.

It’s important to note that Cash App’s fee structure can change, so it’s always a good idea to check the current fees before initiating a transaction. You can usually find this information in the Cash App settings or help section.

Beyond Cash App’s direct fees, you also need to consider potential fees and interest charges from your credit card issuer. As mentioned earlier, transactions may be classified as cash advances, leading to higher interest rates and additional fees. Understanding these costs is essential for making informed decisions about using a credit card on Cash App.

Strategies to Minimize Credit Card Fees on Cash App

While using a credit card on Cash App can be convenient, it’s crucial to minimize the associated fees and interest charges. Here are some strategies to consider:

- Use Debit Cards or Bank Accounts: Whenever possible, opt to use your linked bank account or debit card for Cash App transactions. These funding sources typically don’t incur additional fees from Cash App.

- Check Credit Card Terms: Before using your credit card on Cash App, carefully review your credit card agreement to understand the terms and conditions related to cash advances, including interest rates and fees.

- Pay Off Balances Immediately: If you must use a credit card, make sure to pay off the balance as quickly as possible to minimize interest charges. Consider making payments as soon as the transaction posts to your account.

- Consider a Balance Transfer: If you’ve already incurred cash advance fees and high-interest charges, explore the possibility of transferring the balance to a credit card with a lower interest rate or a promotional balance transfer offer.

- Explore Alternative Payment Methods: Consider using alternative payment methods that may offer lower fees or better terms. For example, some digital wallets or payment apps may provide more favorable rates for credit card transactions.

When Using a Credit Card on Cash App Might Be Justified

Despite the potential drawbacks, there are certain situations where using a credit card on Cash App might be justifiable:

- Emergency Situations: If you need to send money urgently and don’t have sufficient funds in your bank account or debit card, using a credit card can provide a temporary solution. However, be sure to pay off the balance as soon as possible to minimize interest charges.

- Earning Credit Card Rewards: Some credit cards offer rewards, such as cash back or points, for every purchase. If your credit card offers generous rewards and you can pay off the balance quickly, using it on Cash App might be worthwhile. However, carefully weigh the rewards against the potential fees and interest charges. Our analysis reveals that the rewards earned must outweigh the 3% fee plus any potential cash advance fees to make it worthwhile.

- Meeting Spending Requirements: If you’re trying to meet a minimum spending requirement to earn a sign-up bonus or other perks on your credit card, using it on Cash App could help you reach your goal faster. Again, be sure to pay off the balance promptly to avoid interest charges.

Expert Review: Cash App and Credit Card Integration

Cash App’s integration with credit cards offers undeniable convenience, allowing users to send money even when their primary funding sources are limited. However, this convenience comes at a cost. The potential for transactions to be classified as cash advances, coupled with Cash App’s standard transaction fees, can make using a credit card an expensive option.

User Experience & Usability: Cash App’s interface is intuitive and user-friendly, making it easy to add and manage credit cards. The process is straightforward, and the app provides clear instructions. However, the app could benefit from more prominent warnings about potential cash advance fees and interest charges.

Performance & Effectiveness: Cash App generally performs reliably, processing transactions quickly and efficiently. However, the effectiveness of using a credit card depends largely on the user’s ability to manage their credit card balance and avoid interest charges.

Pros:

- Convenience: Allows users to send money even when other funding sources are unavailable.

- Potential Rewards: Offers the opportunity to earn credit card rewards.

- Easy Integration: Seamlessly integrates with credit cards.

- Fast Transactions: Processes transactions quickly and efficiently.

- User-Friendly Interface: Simple and intuitive design.

Cons/Limitations:

- Cash Advance Fees: Transactions may be classified as cash advances, leading to high fees.

- High Interest Rates: Cash advances typically come with higher interest rates.

- Transaction Fees: Cash App charges a fee for credit card transactions.

- Potential for Debt: Using a credit card irresponsibly can lead to debt accumulation.

Ideal User Profile: Cash App’s credit card integration is best suited for users who have a strong understanding of credit card terms, can manage their spending responsibly, and are willing to pay off balances quickly to avoid interest charges. It’s also suitable for users who occasionally need to send money urgently and don’t have other funding sources available.

Key Alternatives (Briefly): Alternatives to using a credit card on Cash App include using a debit card, linking a bank account, or exploring other payment apps like Venmo or PayPal, which may offer different fee structures or terms.

Expert Overall Verdict & Recommendation: While Cash App’s credit card integration offers convenience, it’s crucial to use it responsibly and be aware of the potential costs. We recommend using a debit card or linked bank account whenever possible to avoid fees and interest charges. If you must use a credit card, make sure to pay off the balance quickly and understand the terms and conditions of your credit card agreement. Based on expert consensus, using a credit card should be a last resort, not a first choice.

Navigating Cash App Payments: Your Financial Toolkit

In conclusion, while using a credit card on Cash App is possible, it’s essential to weigh the convenience against the potential costs. Understanding the fees, interest rates, and terms associated with cash advances is crucial for making informed financial decisions. By using debit cards or bank accounts whenever possible and managing credit card balances responsibly, you can minimize fees and avoid debt accumulation. Cash App offers a valuable service, but it’s up to each user to navigate its features wisely.

Share your experiences with using credit cards on Cash App in the comments below. Your insights can help others make informed choices and avoid potential pitfalls.